How to calculate stamp duty?

Stamp duty can be calculated using the CDSL and NSDL calculator. The procedure to calculate stamp duty using the CDSL calculator is given below

- Go to the CDSL Calculator.

- Select ‘Other Transaction‘.

- Enter ‘ISIN Code‘.

- Now enter the taxable amount under ‘Consideration / Invocation Amount‘. It’s calculated by the formula-

Consideration Amount = (No. Of shares)*(Share Price) - And finally, click on ‘Calculate‘

How to pay stamp duty?

There are two depositories and the procedures for payment of stamp duty for both are different.

How to pay CDSL stamp duty?

The payment of CDSL stamp duty can be made by following steps

- Add CDSL’s Stamp Duty account as a Beneficiary in your bank’s online portal.

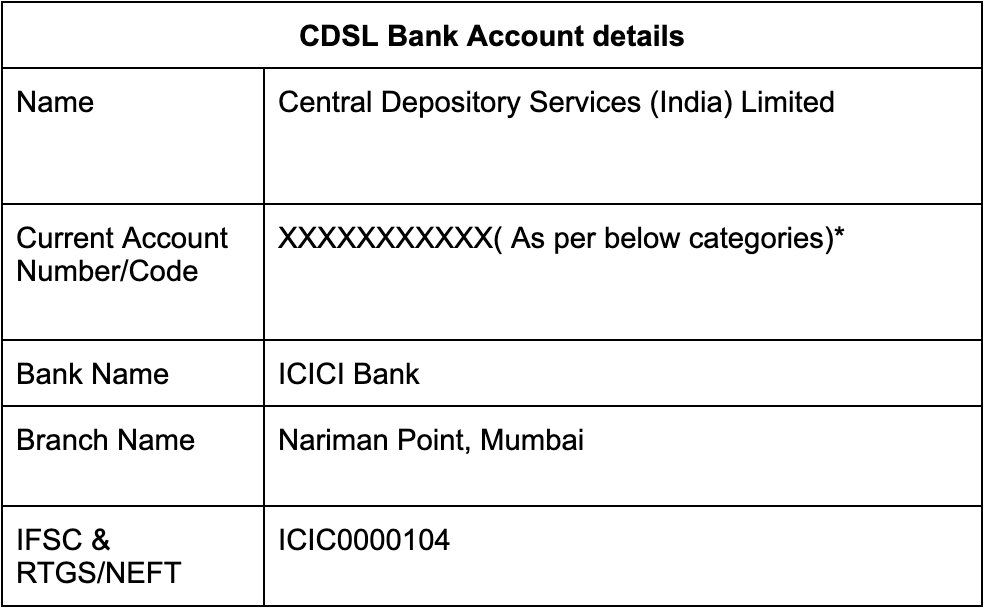

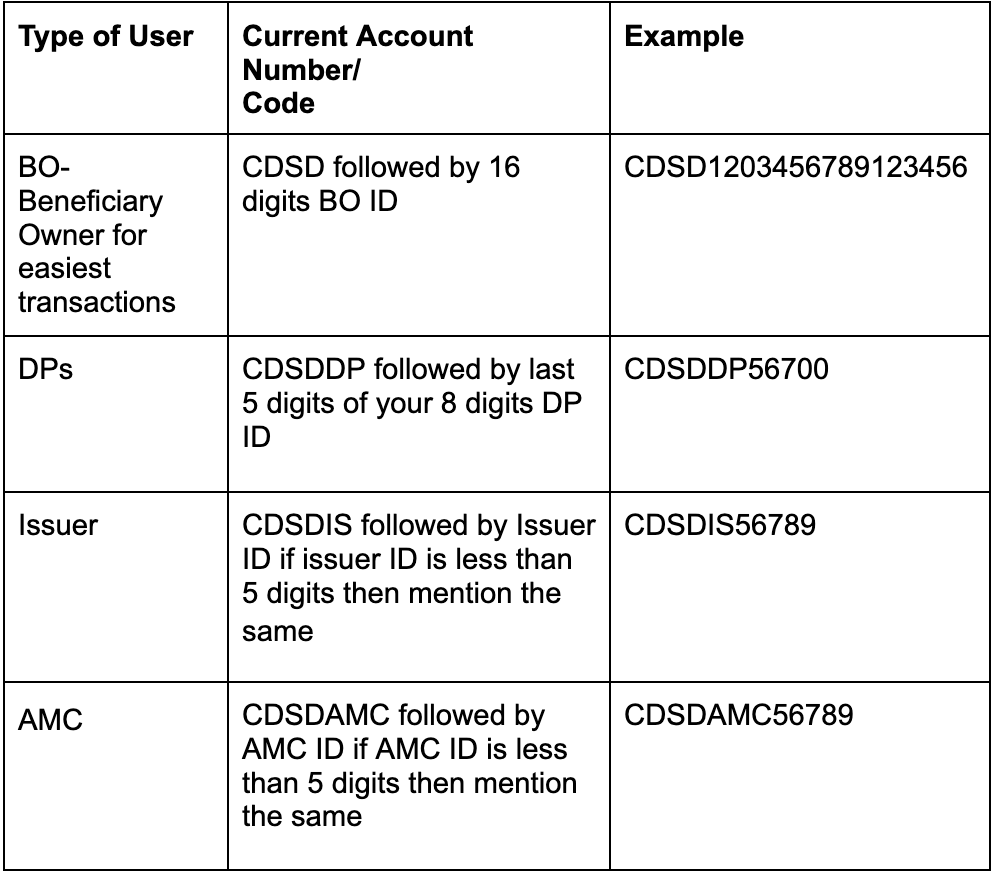

- CDSL’s bank account number is as under

- Make payment for advance stamp duty through RTGS/NEFT/IMPS only. Please note that Cheque, Demand draft and Pay orders will not be accepted for stamp duty accounts.

How to pay NSDL stamp duty?

The payment of stamp duty of NSDL can be made in the following steps

- Click here to pay NSDL stamp duty

- Select the type of security.

- Enter the quantity.

- Enter the price now.

- Enter Consideration/Invocation Amount

- Stamp duty will be calculated automatically. Now click on ‘Pay Stamp Duty‘.

Now a new window will open,

- Fill in your DP name.

- Enter client ID.

- Enter the mobile number registered with the demat account.

- Enter e-mail I’d.

- Enter payable stamp duty.

- Click on ‘Make Payment‘.

You can pay through net banking or UPI directly without adding a beneficiary.